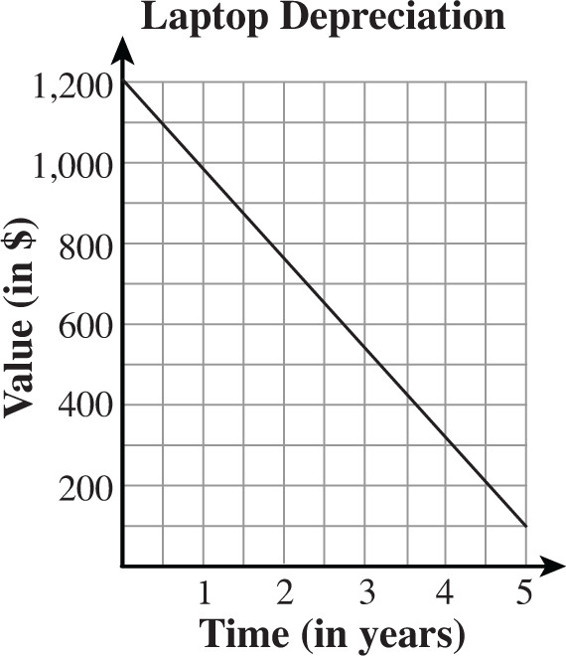

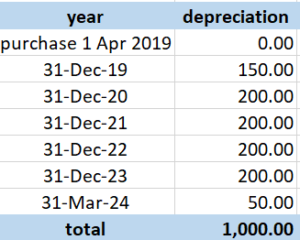

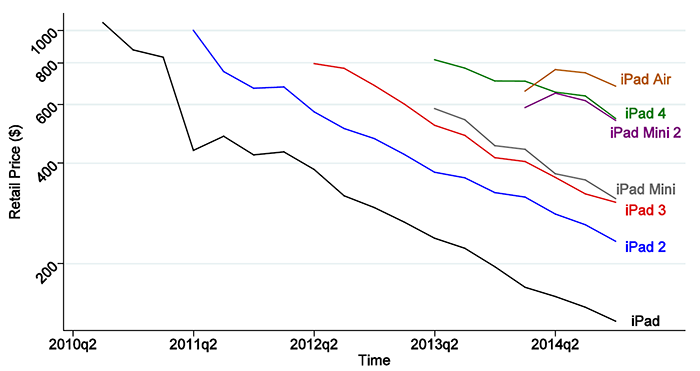

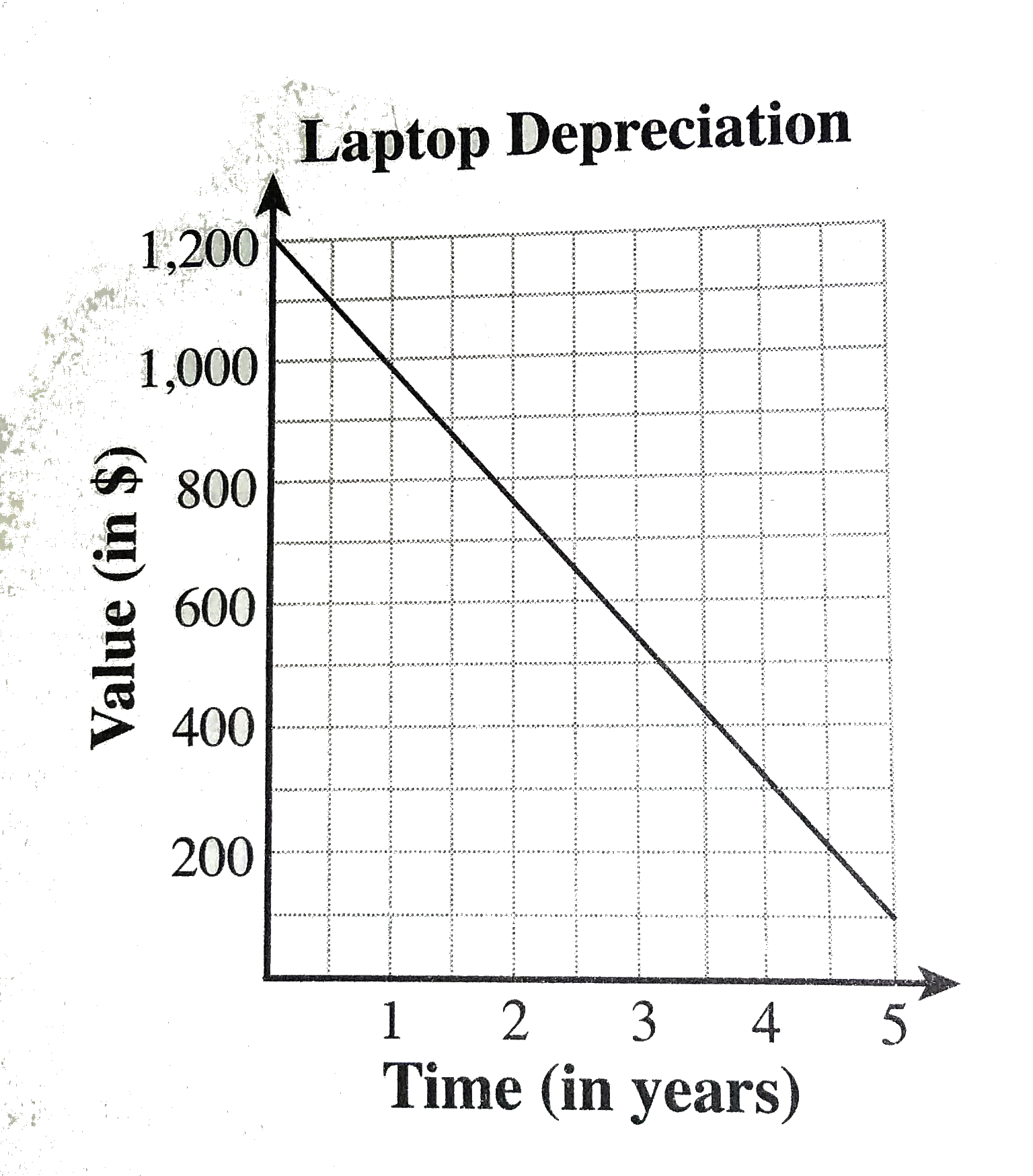

The figure above shows the straight-line depreciation of a laptop computer over the first five years of its use. According to the figure, what is the average rate of change in dollars

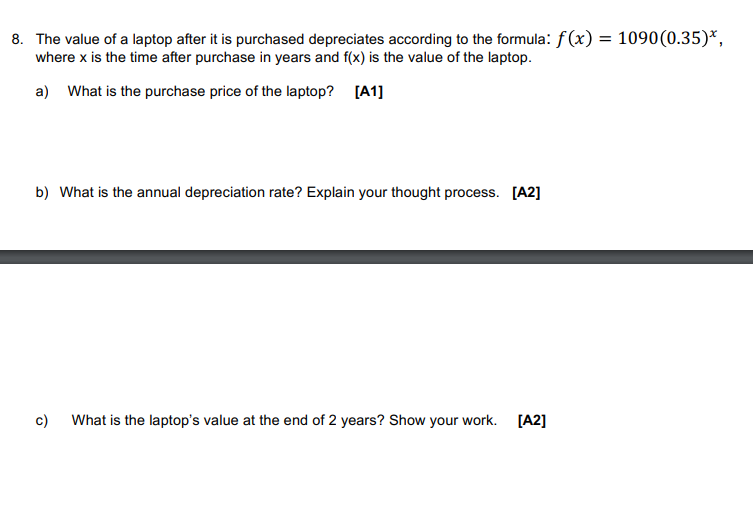

The average rate of depreciation in value of a laptop is 10% per annum. After three complete years its valuewas ksh 35,000. Determine its value at the start of the three-year period.(3marks) -